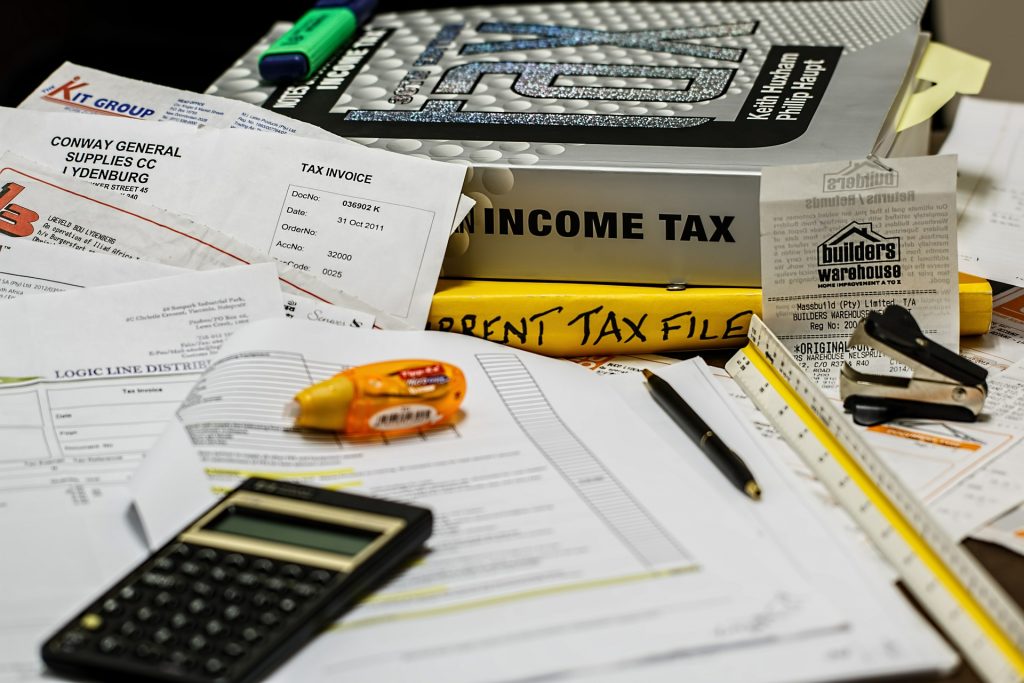

Tax season is a time of the year when many people are looking for accountants nearby. When you require tax accountant services, there are a few things that you should be aware of before choosing an accountant to work with.

a) Tax Accountant Pakenham – these accountants focus on personal tax returns and small businesses;

b) Certified Public Accountant (CPA) – these individuals have passed an exam that allows them to provide auditing services and offer tax advice; 2) Not all tax accountants charge the same rates:

c) The cost can vary depending on whether or not your

Taxes can be a complicated burden for many people to deal with. Trying to make sense of tax laws and policies is difficult enough, but tax accountant Pakenham can help!

The first thing is understanding the difference between an income tax and a capital gains tax. Income taxes are applied on your annual salary or wages. In contrast, capital gains taxes apply to any increases in the value of assets over time.

Next, it’s important to understand what tax deductions are as these reduce your taxable income, which means less money owed for taxes at the end of the year.

If you are new to tax laws and policies, it can be difficult to understand what taxes apply to your annual income or increases in the value of assets over time.

July 8, 2025